KeeperDAO is an on-chain liquidity underwriter for DeFi…

KeeperDAO, an MEV protection protocol on Ethereum, announced today a major update to its DeFi platform. KeeperDAO has introduced a smart contract-based borrowing and liquidation protection service; that gives borrowers the most profitable way to open or upgrade a borrow position on Compound.

The KeeperDAO borrowing platform is composed of three unique products that form the pillars of their engine: a smart contract NFT that can be used with any activated borrowing platform, a collateral booster that helps stave off unnecessary liquidations, and a wrapped version of an underlying borrowing protocol.

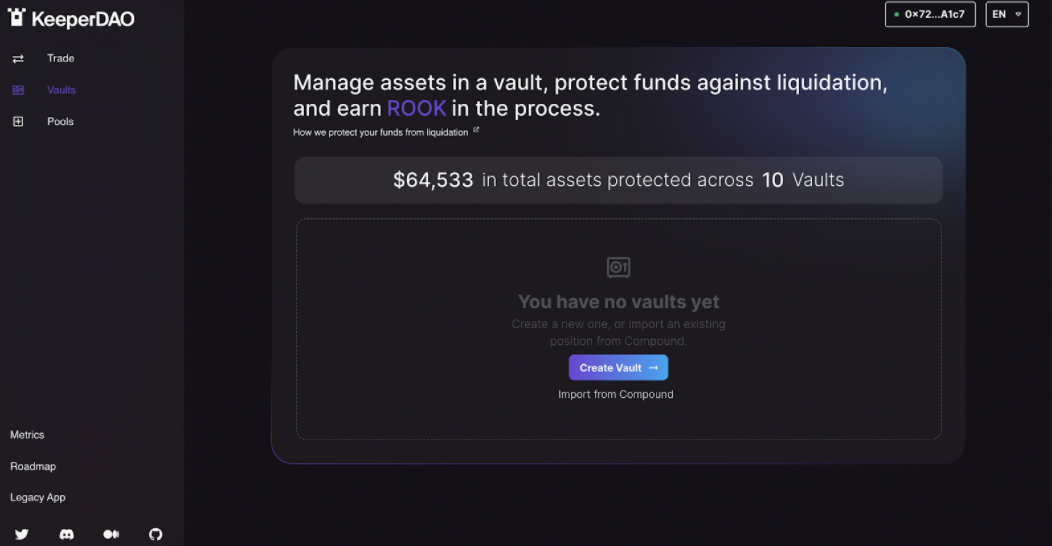

To begin interacting with KeeperDAO’s platform, users mint a Hiding Vault, a modular smart contract NFT that allows them to open or migrate borrow positions from any protocol that KeeperDAO supports.

Feature: Hiding Vaults

Hiding Vaults also allow users to easily transfer positions between different addresses; as well as isolate riskier loans from each other while still using the same Ethereum address. This is a major improvement compared to other liquidation protection services, which spread out the risk across all users, which may result in a user losing funds due to someone else’s risky behavior.

When a loan approaches liquidation, KeeperDAO’s new Just-In-Time Underwriter (JITU) activates. JITU will borrow liquidity from one of KeeperDAO’s deep liquidity pools to protect at-risk Hiding Vault positions.

Providing a temporary loan to buffer a borrower’s position makes the loan appear healthier and prevents an outside liquidation. JITU is able to remove the buffer if the health of the loan improves or the borrower deposits additional collateral. If the loan’s health continues to decline, JITU will perform a liquidation.

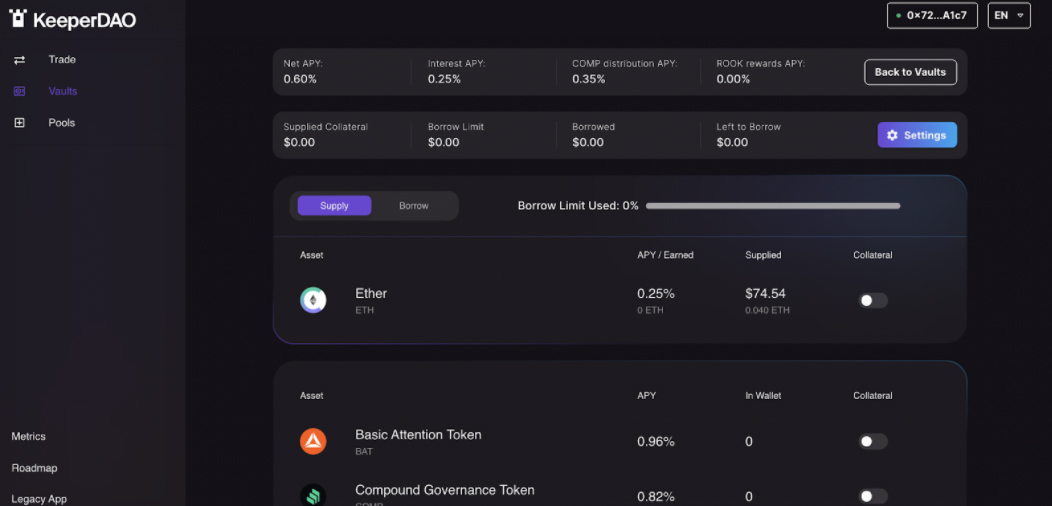

The first enabled borrowing protocol for the Hiding Vault is a wrapped version of Compound, which KeeperDAO calls kCompound.

kCompound lets users deposit collateral and borrow assets as they normally would on Compound to create a position, or simply migrate their entire Compound position over to a Hiding Vault. kCompound gives users all the benefits of Compound, including APYs and COMP rewards, while also rewarding open loans with a tertiary yield, paid out in ROOK.

Roadmap Ahead

The KeeperDAO team is also developing borrowing protection for additional protocols beyond kCompound for the Hiding Vault. They recently announced the successful completion of their kAave Solidity Competition. Two community members were able to successfully simulate the liquidation call function in Aave; a key step in the Hiding Vault’s functionality.

KeeperDAO, with their Hiding Vault borrowing engine and gas-free limit order exchange, aims to increase offering back user’s MEV that is created by their trades and loans and will continue to advance the MEV protection space. Moreover, KeeperDAO is currently designing ways for market makers to coordinate in redistributing MEV from miners through their upcoming Coordination Game.

“Prior to KeeperDAO’s inception, there was no solution for Ethereum users losing MEV. We are providing the infrastructure to align incentives between users, keepers, borrowers, DeFi products, and liquidity providers. We are leading the charge in protecting and bringing MEV back to users. So far it is greatly succeeding at improving the quality of life for the ecosystem.”

– Joey Zacherl, Founding Partner at KeeperDAO