The drama between Twitter (TWTR) – Get Twitter, Inc. Report and Tesla (TSLA) – Get Tesla Inc Report CEO Elon Musk refuses to vacate, but can anyone be surprised?

Musk’s $54.20-a-share proposal to buy Twitter — equating to a $44 billion deal — has generated a ton of hype.

Today, we see Tesla shares ripping and Twitter stock falling — the latter down 9% — as Musk said, “Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users.”

He later tweeted that he’s “still committed to acquisition.”

As some have speculated — namely Hindenburg Research, which is actively shorting Twitter stock — the idea of a lowered buyout price could be a reality.

On the other hand, you have to wonder whether this is Musk toying with the shorts in Twitter. He’s publicly complained about short sellers, and I would not put something like this past him.

Trading Twitter Stock

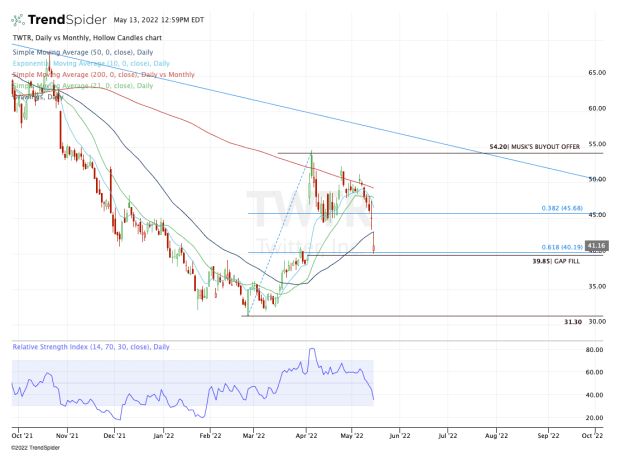

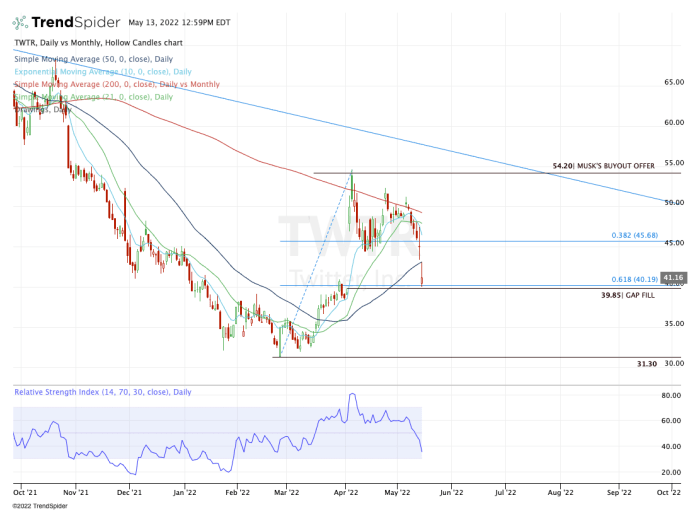

Daily chart of Twitter stock.

Chart courtesy of TrendSpider.com

Given the recent rout in the stock market — and in particular, in growth stocks — Twitter stock almost undoubtedly would be thrashed if Musk decided to pull out of the deal.

Now, granted, he said he was still planning on making the acquisition, but the idea that a lower offer could be floated is intimidating. That’s especially once egos become involved and then the whole deal risks falling through.

Scroll to Continue

As it pertains to the chart, today’s drop nearly filled the gap from early April down at $39.85. I personally would have liked to see this gap filled before Twitter bounced back over the 61.8% retracement.

But it’s being rejected by the 50-day moving average and Thursday’s low as doubts about the buyout price swirl. Shorts are getting paid handsomely on their bet now.

This one is completely binary. If Musk maintains his buyout offer at $54.20, Twitter stock will fly. If he pulls out completely, I can’t imagine a scenario where the shares do not make new lows.

If the new deal is somewhere in between the recent low and $54.20, well, the stock will be volatile.

Trading Tesla Stock

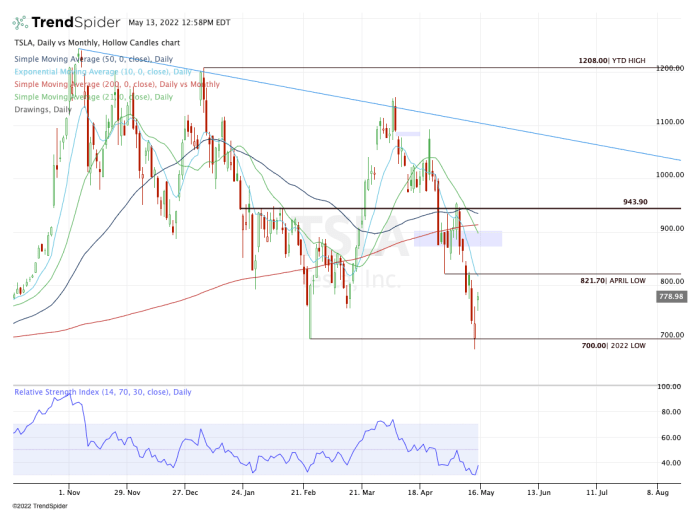

Daily chart of Tesla stock.

Chart courtesy of TrendSpider.com

As for Tesla stock, it had an obvious level for longs to keep an eye on before this news hit the wires.

The stock breaking and then reclaiming $700 was key, as it was the prior 2022 low. Now that it’s powering higher, Tesla stock is approaching the April low and the declining 10-day moving average.

This will be the first important level to see how the stock responds. If the sellers take control, it could put $730 to $750 back in play.

However, if Tesla can reclaim the April low near $820, it could open the door back into the $850-plus region and put the 21-day moving average in play.