Key Takeaways

- More than 3,200 long Bitcoin positions have been filled over the last week.

- Meanwhile, whales have added 60,000 Bitcoin to their holdings within the same period.

- A daily close above $49,650 could kick start the next leg up for the top crypto asset.

Investors appear to be re-entering the market as long Bitcoin positions increase while whales add tokens to their holdings. Although the recent spike in buying pressure looks encouraging, BTC still has one crucial obstacle to overcome.

Bitcoin Buy Orders Are Getting Filled

Whales have turned their attention back to Bitcoin.

The flash crash of Sep. 7 has sent market participants into fear. Now, some of the most renowned technical analysts in the crypto industry maintain that Bitcoin’s rejection from $53,000 could lead to a catastrophic outlook.

For instance, the analyst operating under the alias dave the wave believes that the flagship cryptocurrency would drop toward $30,000. They stated that the recent downward pressure could accelerate into a more significant downtrend as the moving average convergence divergence or MACD had a bearish cross on BTC’s monthly chart.

It’s the monthly MACD, still high [and just crossed bearishly], that adds weight to further consolidation in price. pic.twitter.com/wzScqbMRWM

— dave the wave🌊 (@davthewave) September 13, 2021

Despite the bearish worst-case scenario, several fundamental factors suggest that some investors have taken advantage of the price drop to buy Bitcoin at a discount.

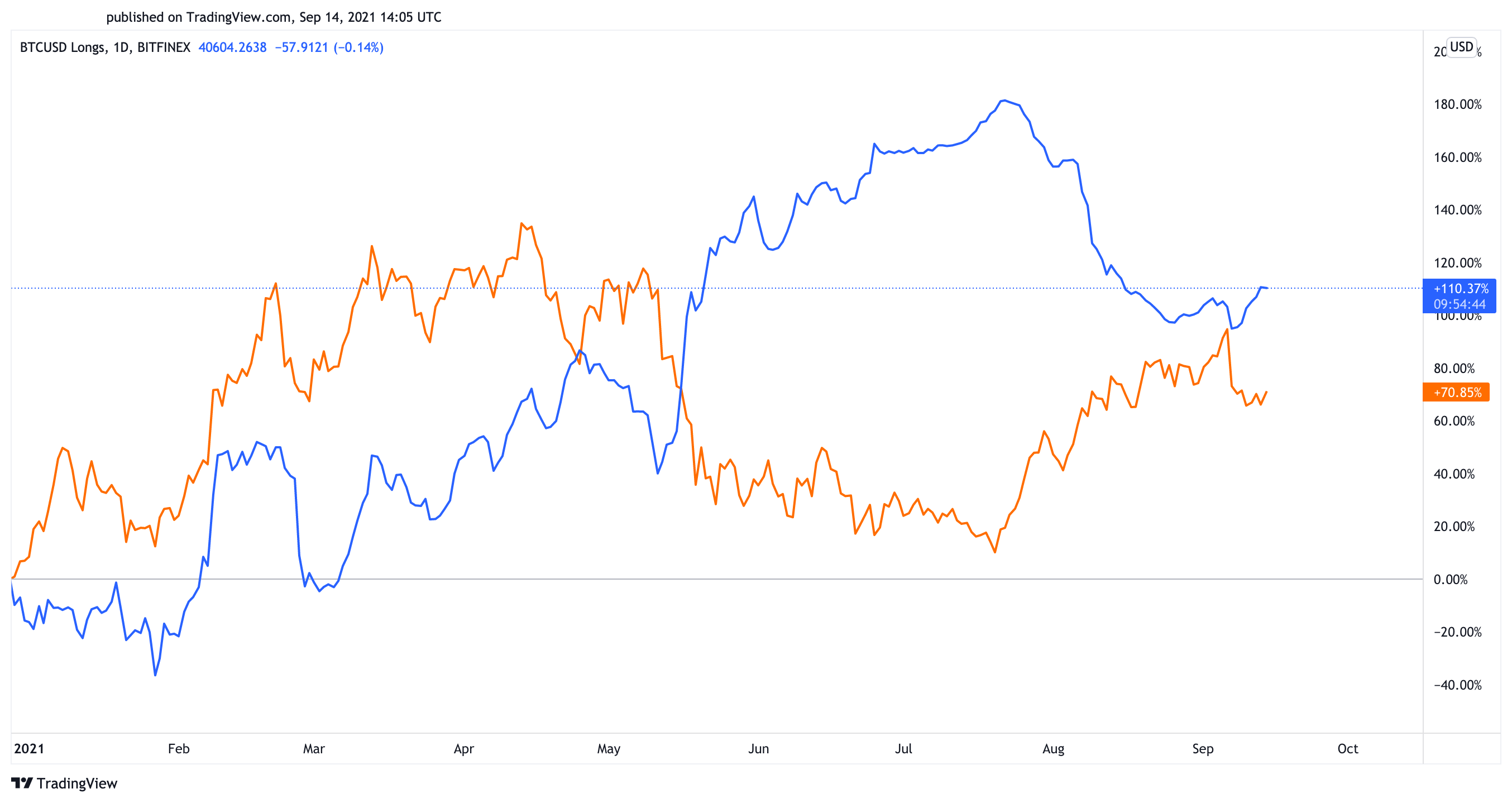

The number of long Bitcoin positions in Hong Kong-based cryptocurrency exchange Bitfinex has made a higher high for the first time since Jul. 22. More than 3,200 long positions have been created over the last week alone, suggesting that some traders have bought the dip.

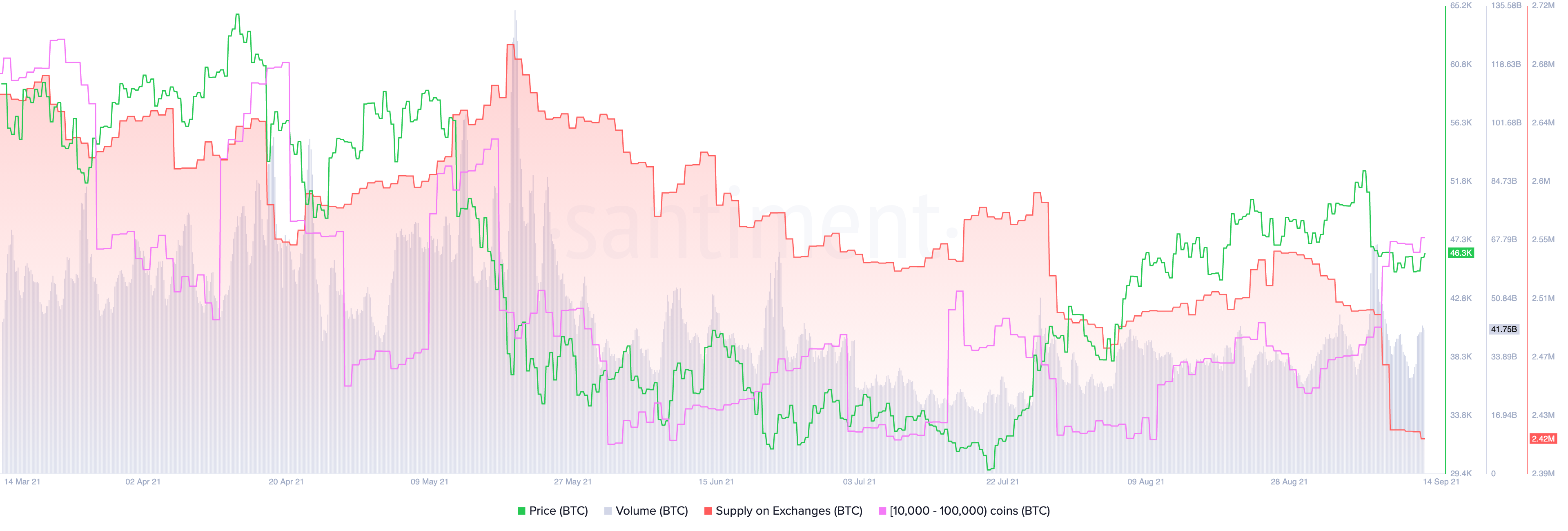

Similarly, behavior analytics platform Santiment shows that whales are accumulating.

Addresses holding 10,000 to 100,000 BTC have purchased over 60,000 BTC worth roughly $2.82 billion within the same period. This significant number of tokens were also removed from known cryptocurrency exchange wallets, reducing the selling pressure behind Bitcoin.

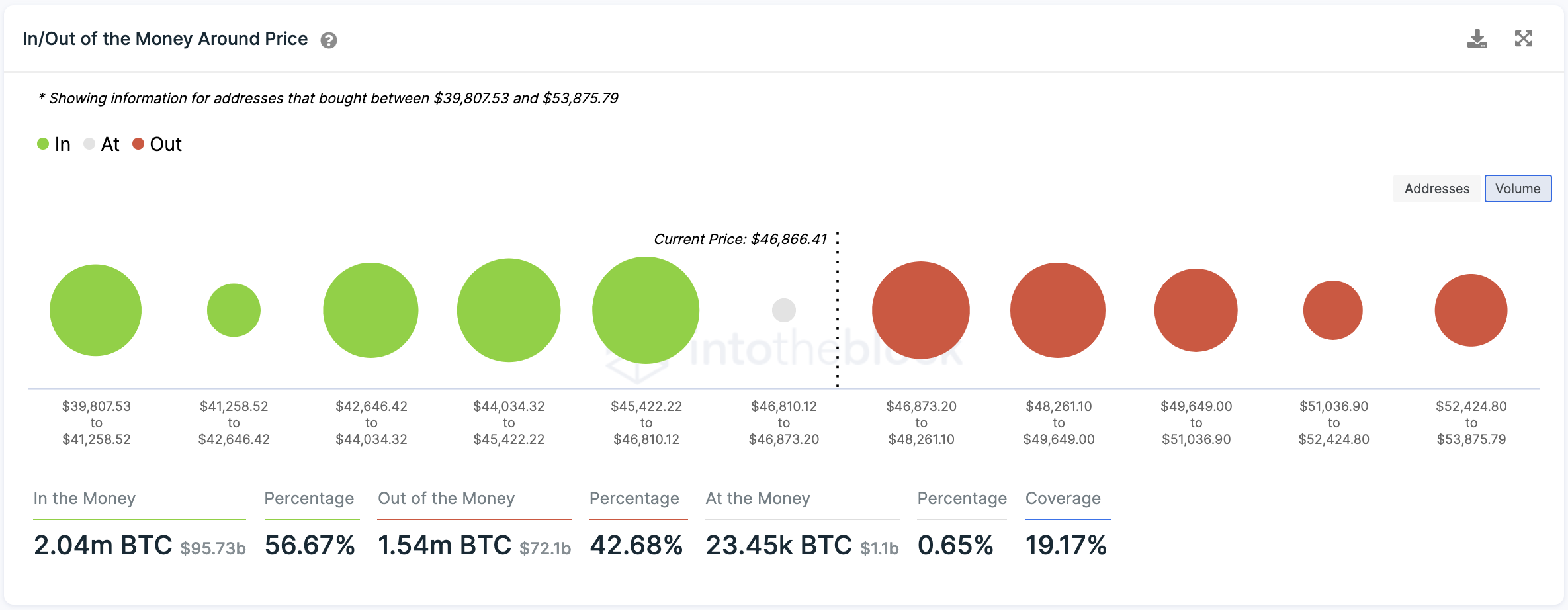

While buy orders are piling up, IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows a major supply barrier ahead of Bitcoin. Roughly two million addresses have previously purchased nearly 900,000 BTC between $46,900 and $49,650.

Only a daily candlestick close above this resistance wall would signal the resumption of the uptrend.

On the other hand, Bitcoin must hold above the $44,000 to $46,800 support zone to avoid further losses. Slicing through this significant interest area may encourage investors to sell their BTC to prevent seeing their investments go “Out of the Money.” In this eventuality, a downswing to $38,000 could play out.

This news was brought to you by Phemex, our preferred Derivatives Partner.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

El Salvador Won’t Tax Foreign Investors on Bitcoin Profits

News

El Salvador is reportedly moving to exempt foreign investors from paying taxes on their Bitcoin gains. No Bitcoin Taxes for Foreigners El Salvador plans to make foreign investors exempt from…

Ukraine Passes Law to Legalize Bitcoin, Crypto Businesses

News

Ukraine’s lawmakers have voted in favor of legalizing crypto ownership and businesses operating in the space. Ukraine Gives Citizens Right to Own Crypto Ukraine has become the latest country to…

What is Impermanent Loss and How can you avoid it?

DeFi has given traders and investors new opportunities to earn on their crypto holdings. One of these ways is by providing liquidity to the Automated Market Makers (AMMs). Instead of holding assets,…

Microstrategy Adds to Bitcoin Stash, Now Holds $5.1B

News

MicroStrategy has purchased another 5,050 Bitcoin, bringing its total holdings to 114,042 BTC. MicroStrategy Increases BTC Holdings MicroStrategy has added a further 5,050 bitcoin to its holdings. The U.S. business…